Podcast: Play in new window | Download

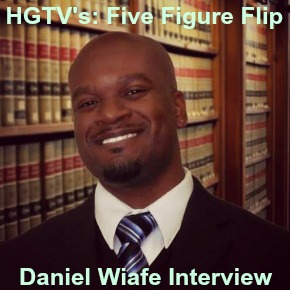

In Episode 20, our “Spokane Project” client Danny, is still working through all his leads and is coming very close to closing a deal. In the “Market Recap” Segment, Tucker talks about what he’s seeing in the trenches this week. In the “Deal of the Week” he goes into detail about a rehab project that is currently in process. In this weeks “Main Topic” Tucker Interviews House Flipping TV Star, Daniel Wiafe from HGTV’s “Five Figure Flip” Show. In our most popular segment, “Direct Mails Greatest Hits”, we share a voicemail that one of our Listeners sent in. Tuckers “Golden Nugget” for the week is all about rehabbing in Historic Neighborhoods and why you may not want to. In the “No BS Zone” segment, he talks about some recent news from Seattle, WA and its economic effects. Tucker then ends the Episode with a great Success Quote from Harold S. Geneen. We hope you enjoy this episode and please leave us comments and reviews!

In Episode 20, our “Spokane Project” client Danny, is still working through all his leads and is coming very close to closing a deal. In the “Market Recap” Segment, Tucker talks about what he’s seeing in the trenches this week. In the “Deal of the Week” he goes into detail about a rehab project that is currently in process. In this weeks “Main Topic” Tucker Interviews House Flipping TV Star, Daniel Wiafe from HGTV’s “Five Figure Flip” Show. In our most popular segment, “Direct Mails Greatest Hits”, we share a voicemail that one of our Listeners sent in. Tuckers “Golden Nugget” for the week is all about rehabbing in Historic Neighborhoods and why you may not want to. In the “No BS Zone” segment, he talks about some recent news from Seattle, WA and its economic effects. Tucker then ends the Episode with a great Success Quote from Harold S. Geneen. We hope you enjoy this episode and please leave us comments and reviews!

Episode 20 Segment Notes:

- Intro/Summary

- Spokane Project: Danny is getting very close to closing a Deal!

- Market Recap: Local Market Recap from the Trenches

- Deal of the Week: In process Rehab Deal

- Main Topic: Interview with Daniel Wiafe From HGTV’s Five Figure Flip

- Direct Mails Greatest Hits: A Listener sends in a direct mail voicemail he received

- Golden Nugget: Historic Neighborhoods

- No BS Zone: Seattle, WA Minimum Wage News

- Success Quote: Harold S. Geneen

- Ending Music: 2Pac – Still Ballin

- Transition Music: Various Artists

Links:

Contact Email:

- Tucker@TheRealDealzPodcast.com

- Info@TheRealDealzPodcast.com

Thank you for listening to our Podcast and please give us a review on iTunes and feel free to leave a comment below. Additionally, if you have any questions or would like Tucker to cover a specific Topic, please let us know and we can cover it in a future episode! Thanks again!

June 9, 2014

Great show!

Spot-on analysis of Seattle’s asinine minimum wage law. As Thomas Sowell writes in Basic Economics, the true minimum wage is zero. That’s the wage for all the employees of the businesses that either shut down or don’t start because of this law.

June 9, 2014

Travis,

Thanks for the kind words.

I would also be in agreement with Thomas Sowell!

Dan

June 10, 2014

Another great podcast Tucker. Probably the best podcast out there for real estate. To the point.

I will comment on the Seattle wage law though. There are 3 things “probably more” that can happen not just the two dismal things pointed out. This was actually an essay I did in college in an economics class about 8 years ago. The class was part of my business major so I wasn’t an economics major but some classes did overlap. The topic was the effect of minimum wage increases and higher taxes on jobs. I was trying to see by example whether areas, states, provinces and countries had job losses due to a sudden raise. In every case the net jobs increased not decreased.

I wan’t sure what to believe before I did that essay and really I still don’t. There were many other factors involved in those markets. That being said just based off the numbers Id have to say the opposite is true. I could not find one example of a net loss. The areas in my research were all decent sized economies to begin with so if this happened in maybe some tiny backwoods town the conclusion might have been different.

I came to the conclusion, that like Seattle , most jobs were higher than minimum wage anyways so most of them weren’t affected. The businesses that did go under were barely making it before the wage increase and in my opinion probably were over saturated and tried to make a business where there wasn’t one. If you barely can make it paying minimum wage your not really in a business your forcing yourself to have a job. Ex: some Restaurants –(If I did the same paper today coffee stands would be in my paper which I own several now and have had some go and some thrive), went out of business in the research. The ones that didn’t gained the other customers. The prices did not necessarily go up because of wage increases. The leftover restaraunts had a larger customer base and in some instances hired extra workers where they normally only needed a few they had to have more. The employees that lost their jobs because of the folding businesses were aborbed into the other restaraunts.

The thing with small businesses like that is that even though wages are a chunk of the costs. They are still small in comparison. Most businesses like that do not base their margins or change them no matter what they make so to say that they would automatically raise their price because of less profit is not necessarily true. Although some will. The businesses that barely get by will either raise their price or try to cut wages. In those cases they should consider closing. Or the owner if they want to stay in business can choose to work more hours. No shame in closing and starting in a new location. For coffee stands, just an example. You need to gross about 260.00 a day to break even thats utilities, lease, equipment, food costs and wages. After that the profit per cup is extremely high. Good stands gross between 600 and 2000 a day. Ok stands about 350 to 450. The ones that are break even or a little better are on the verge anyways and are really a job for the owner. Over saturation is what kills most businesses today, and it helps keep prices low as well but Just like with real estate like with every other profitable business people start hurding in to the money and then there isn’t any.

That being said no area I researched had raised the wages that much as a percent. So we will see. Are they raising them in phases or all at once, that might effect it as well.

June 13, 2014

Jason,

I will let Tucker respond on this one 😉

Dan